Good evening, everyone. By way of a brief introduction, I’m the Head of Research at TheCityUK, which, for those of you who may not be familiar with the organisation, is the industry body representing UK-based financial and related professional services. Our members span the full range of FS (banking, insurance, asset management and market infrastructure); and legal, accounting and consulting on the professional services side.

My role is to run the organisation’s economic research programme, which ranges from annual statistical updates of some of our flagship research to more occasional sector-focused or thematic work. For example, we recently launched major new research on green finance.

But one of TheCityUK’s Strategic Priorities is what we call our Regions & Nations programme, which is designed to emphasise the contribution the industry makes to all parts of the UK, not just London. Of the 2.2 million people working in financial and related professional services, two thirds are outside of London. TheCityUK has a network of seven Regional and National Chairs in each part of the UK that has a significant industry hub. These Chairs are front-line practitioners who bring together a network of industry partners and other regional economic partners in each region; in this convening role, they act as experienced sounding boards for developing and promoting policies on regional growth. And what I plan to share with you today is highlights from our economic research which is the cornerstone of our Regions & Nations programme.

I’m absolutely delighted to have been able to work with Quantuma and Laeceum, and to be sharing this platform with them today because I really think this evening will be a terrific example of something where the whole will be greater than the sum of the parts.

***

Before I share with you our research highlights, let me put things in a broader context.

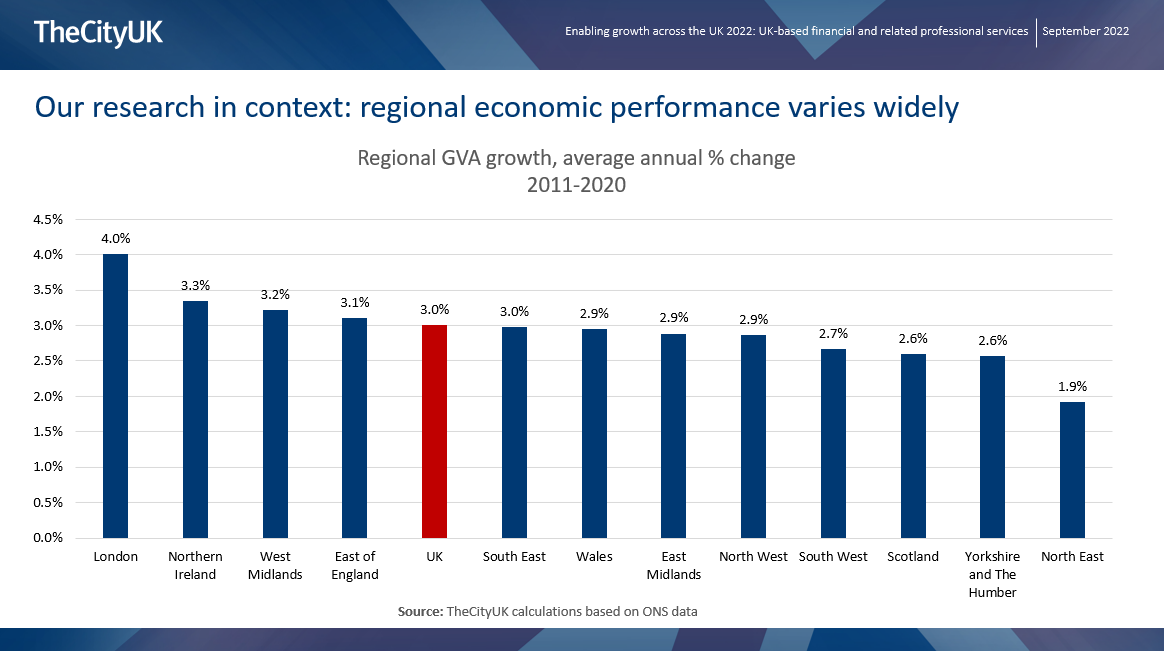

Here we can the overall economic growth rates of each region and nation over the past decade. And you can see the disparity in economic performance of the regions and nations, and the extent to which UK GDP growth has been driven by growth in London, and to some extent the West Midlands.

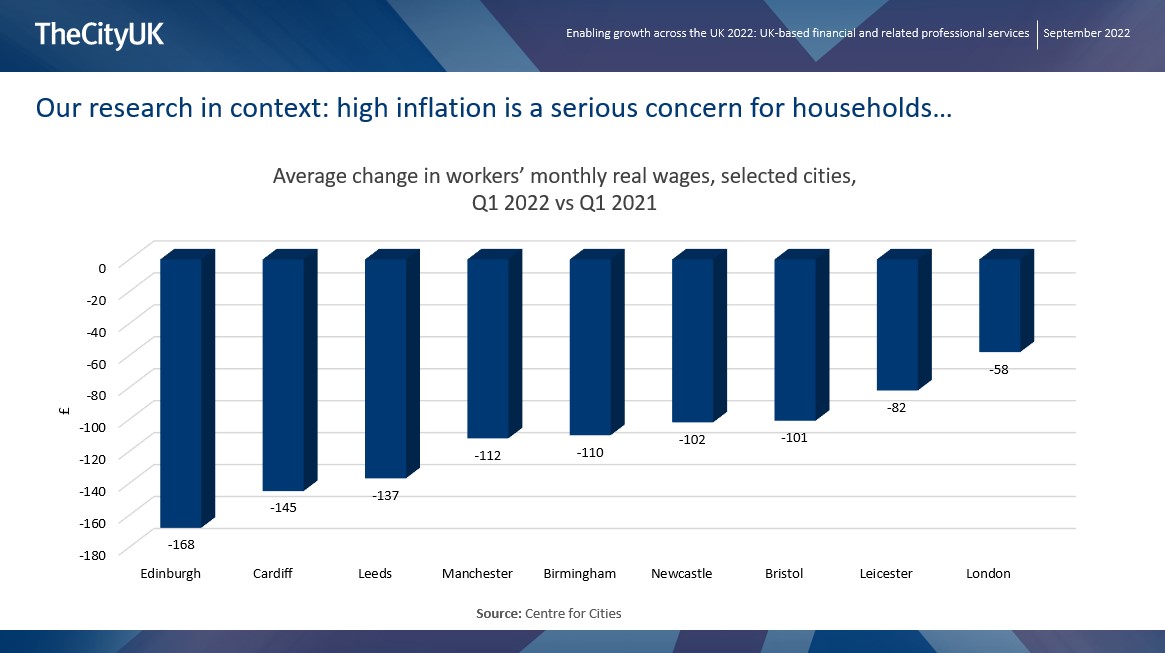

And here what we see is the variation in the extent to which the current cost-of-living crisis is affecting different regions. This is data from the Centre for Cities, and it shows the change between last year and this year in average inflation-adjusted wages in various cities across the UK. And you can see that the impact is far from uniform, some areas are much more affected than others. We’d need a whole conference just to unpack this but a lot of this has to do with the way household spending can vary by city, which in turn is linked to geographic factors but also to regional differences in average income.

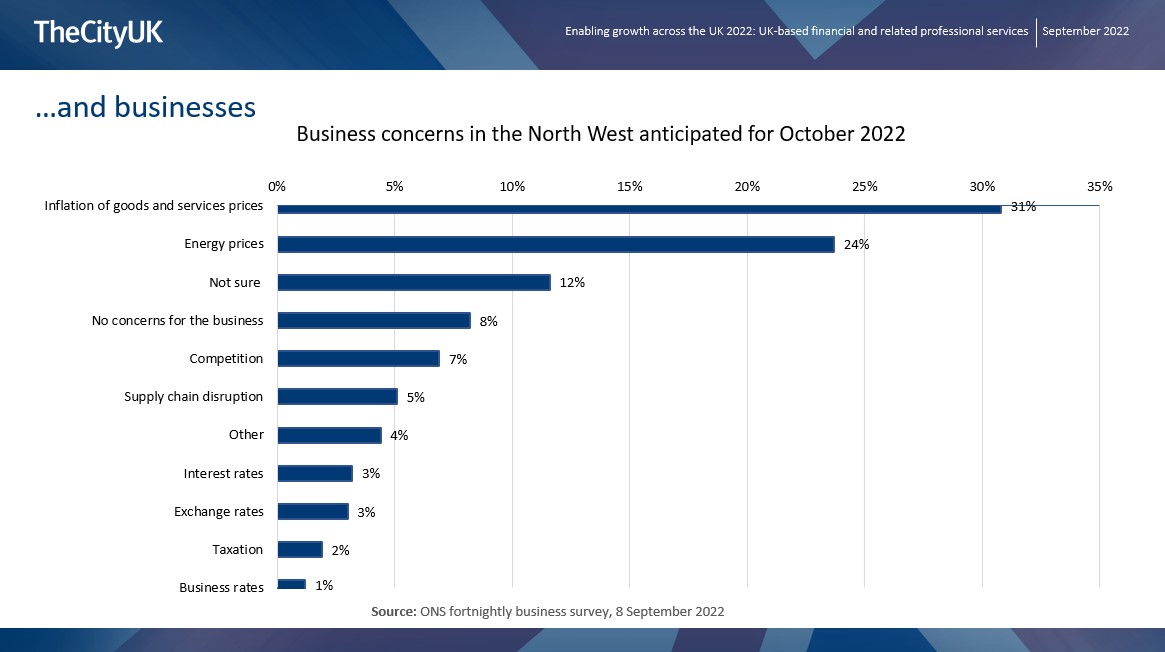

And while we all know that the cost of living is right at the top of consumers’ list of concerns at the moment, here we see that it’s also the foremost concern of businesses.

The data here are specifically for the North West, but the results were broadly similar across all the regions.

Earlier this week I spoke at the Annual Conference of the charity FairLife, which focuses on fair trading in finance and financial education. And one of the issues we were discussing is who is going to feel the impact of the current inflationary crisis first. One of the points I made was that on the business side, firms whose products and services are discretionary are of course likely to be harder hit as households suffer falls in their disposable income. But also, that SMEs often have smaller financial buffers and less sophisticated hedging and risk strategies than larger firms, so are more likely to struggle in this period than large firms.

I’d also point out, I thought it was interesting that a non-trivial 12% of respondents to this ONS survey said they weren’t sure what their main near-term concern was. I think that says a lot about the extreme uncertainty we face, and also possibly something about how quickly economic conditions are changing.

So with that context, we come on to the role that financial and related professional services can play in the regions and nations, to help mitigate some of the very real and pressing challenges that are being felt and will be felt to different degrees in different parts of the UK.

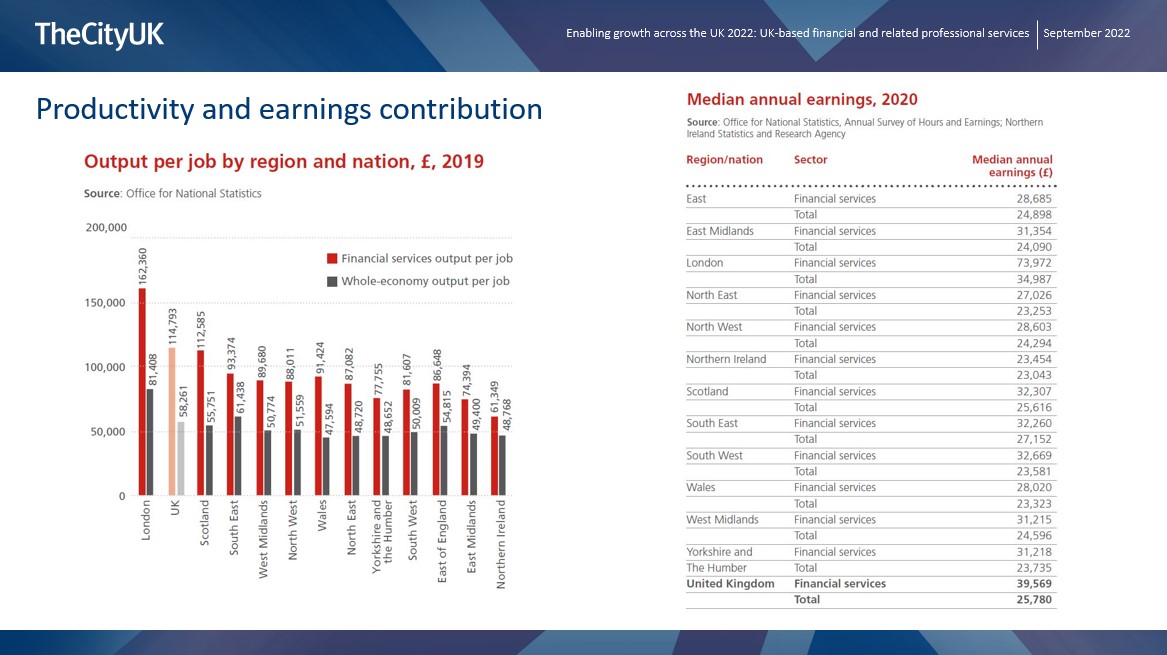

The chart, for example, shows you that financial services productivity is around twice as high as productivity in the UK economy as a whole. Output per job is about £58,000 for the economy as a whole, but around £115,000 for financial services. That difference is in evidence not only for the UK, but for every region and nation within the UK. For example, here in the North West productivity in financial services is about 70% higher than productivity in the economy overall.

The table on the right complements this data by highlighting that across the UK, average earnings in financial services are higher than average earnings in the economy as a whole. The UK average is around £26,000 overall but around £40,000 for financial services, but that kind of discrepancy exists in every single region and nation (although of course the size of the gap varies from region to region). Here in the North West, financial services offers average annual wages around £10,000 higher than the average for the economy as a whole.

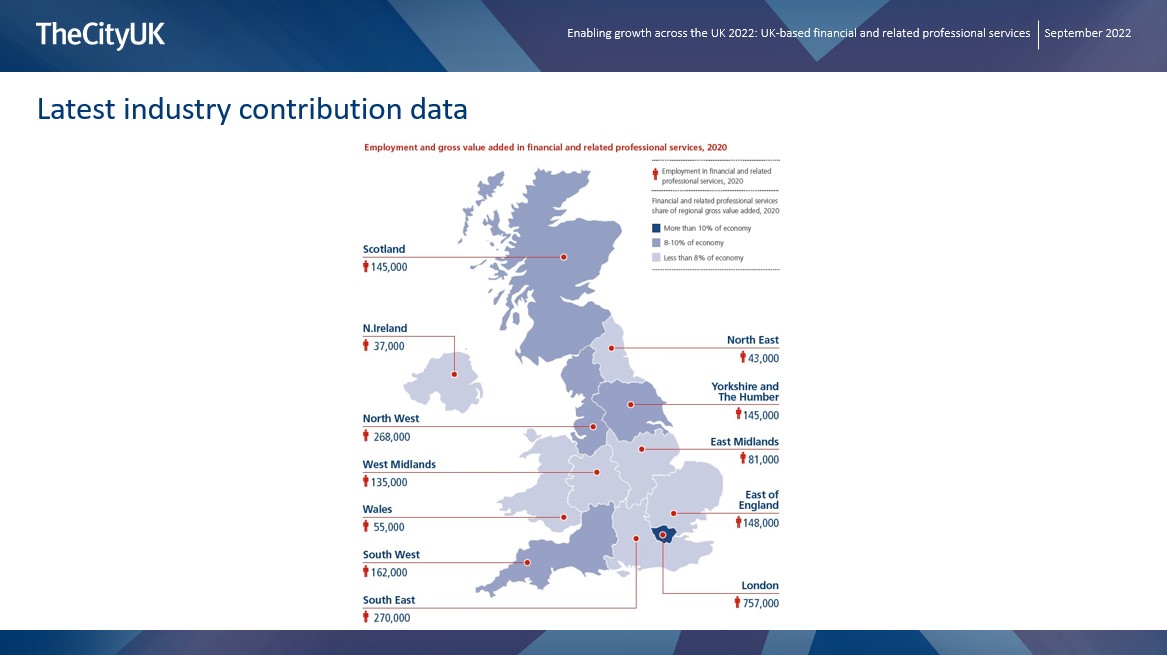

These charts are in our new report, but the core of our new research, which we launched just about ten days ago, is summarised graphically here:

We’ve quantified the contribution that financial and related professional services makes to each UK region and nation, measured by industry employment and GVA. So here you can see in broad terms the spread of that contribution. The figures are the employment contribution and the shading shows you that financial and related professional services represents anywhere from 5% of regional economies (in regions like the East Midlands) up to almost 9% here in the NW and almost 10% in Scotland.

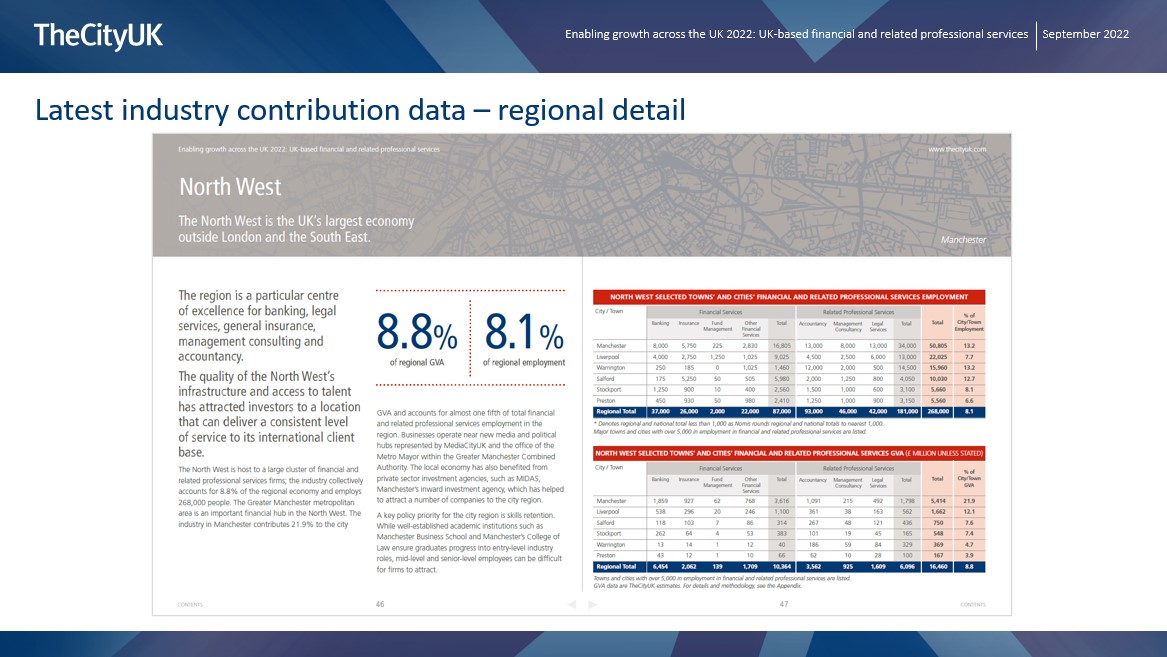

So that’s a snapshot, but we have lots of detailed data, as you can see here:

We broke down industry employment and GVA by regions and cities, and also looked at data in the different sub-sectors of banking, insurance, fund management; and legal, accounting and management consulting.

Here as you can see I’ve shown the detail for the NW region. Our analysis shows that financial and related professional services accounts for almost one-quarter of the economy of Manchester, and almost one-fifth of employment in the city. That employment is concentrated in professional services rather than financial services, particularly in legal services and accounting—indeed, the North West region is the UK’s 2nd largest legal centre after London. But in Manchester there are also 8,000 people employed in both banking and in management consulting.

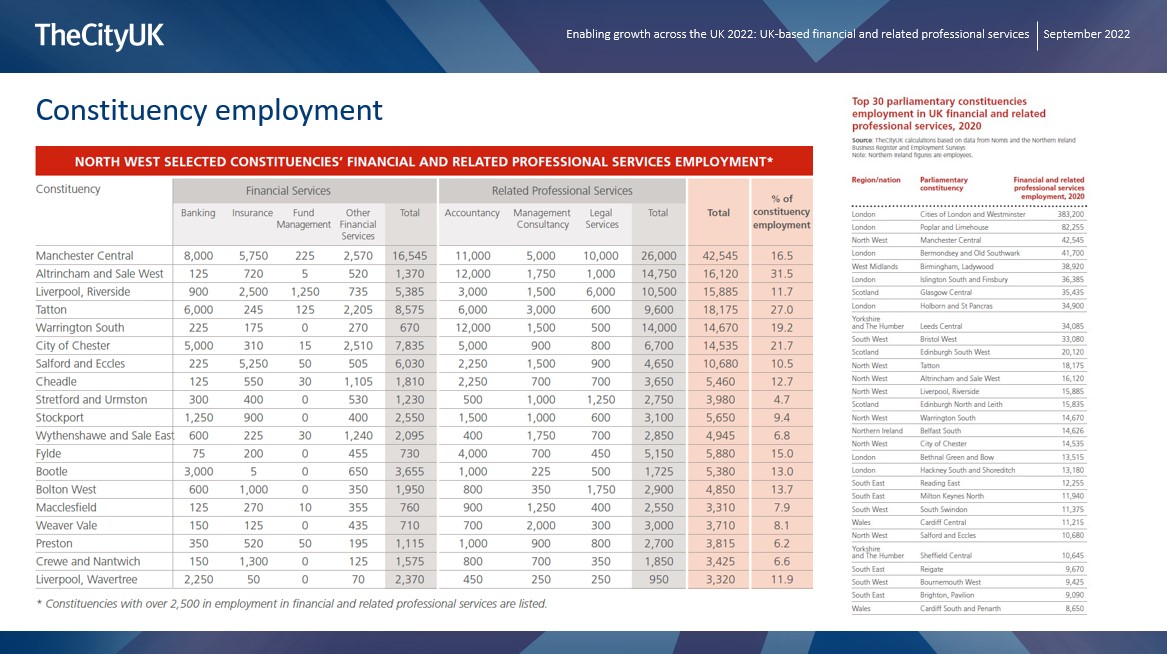

You can see here that we’ve even drilled down to industry employment at the constituency level. You can see that - no surprise - Manchester Central is the leading constituency in the region in terms of industry employment. And I’d encourage you to take a closer look at the research in your own time and of course to speak to me after the formal part of the evening if you’d like more information.

Another feature of the report is the policy recommendations we’ve included as suggestions for how the industry’s ability to support individuals and businesses can be enhanced by working in partnership with government.

These are grouped into 5 themes, and here you see some examples of recommendations in the first two themes: driving devolution and skills—things like expanding and enhancing the model of Metro Mayors and Combined Authorities; and reforming the Apprenticeship Levy.

And our other recommendations are in the areas of driving growth through international trade and green industries; having the government lead by example; and infrastructure and investment.

So the main message from our new research is that financial and related professional services is a structurally important industry in the UK, and its economic contribution is felt across the whole country, not just in London.

But I want to conclude with this slide:

On the left you see business creations and business closures in the North West. Business births in the region decreased by a modest 2% year on year in the first half of this year—but the number of business closures increased by 21% in the same period. And we see that business closures have outpaced business births for 5 consecutive quarters now.

Already this starts to give us a bit more insight into business conditions and trends in the region. And ideally what we’d love to have is data on creations and closures by sector. As you can see from the chart on the right, this data is available on a UK-wide basis, but not at a regional level.

But you can see how if we were able to combine macroeconomic data like what we feature in our new report with microeconomic data, we’d have a much more nuanced picture of business conditions and trends with regional and sectoral detail. And this would be very helpful both for making forward-looking projections, and also for refining the type of policy recommendations that are such an important part of corporate engagement with government—all with a view to creating the strongest possible environment in which businesses can thrive, particularly as we head into some very choppy economic waters.